Tax Related News

How to search for system generated Paying-in-slip Number/ Payment Voucher Number /DIN number

Department of Inland Revenue has introduced a search facility to obtain system generated Paying-in-slip Number/ Payment Voucher Number /DIN number. Link to Search Paying-in-slip Number/ Payment Voucher Number /DIN number.

Proposed Tax Reforms 2022

Prime Minister’s Media Division has published Proposed Tax Reforms in 2022 which are effective from 01 October 2022 other than the following: VAT Rate change from 8% to 12% Telecommunication Levy change from 11.25% to 15% Download the details version of the proposed Tax Reforms in 2022

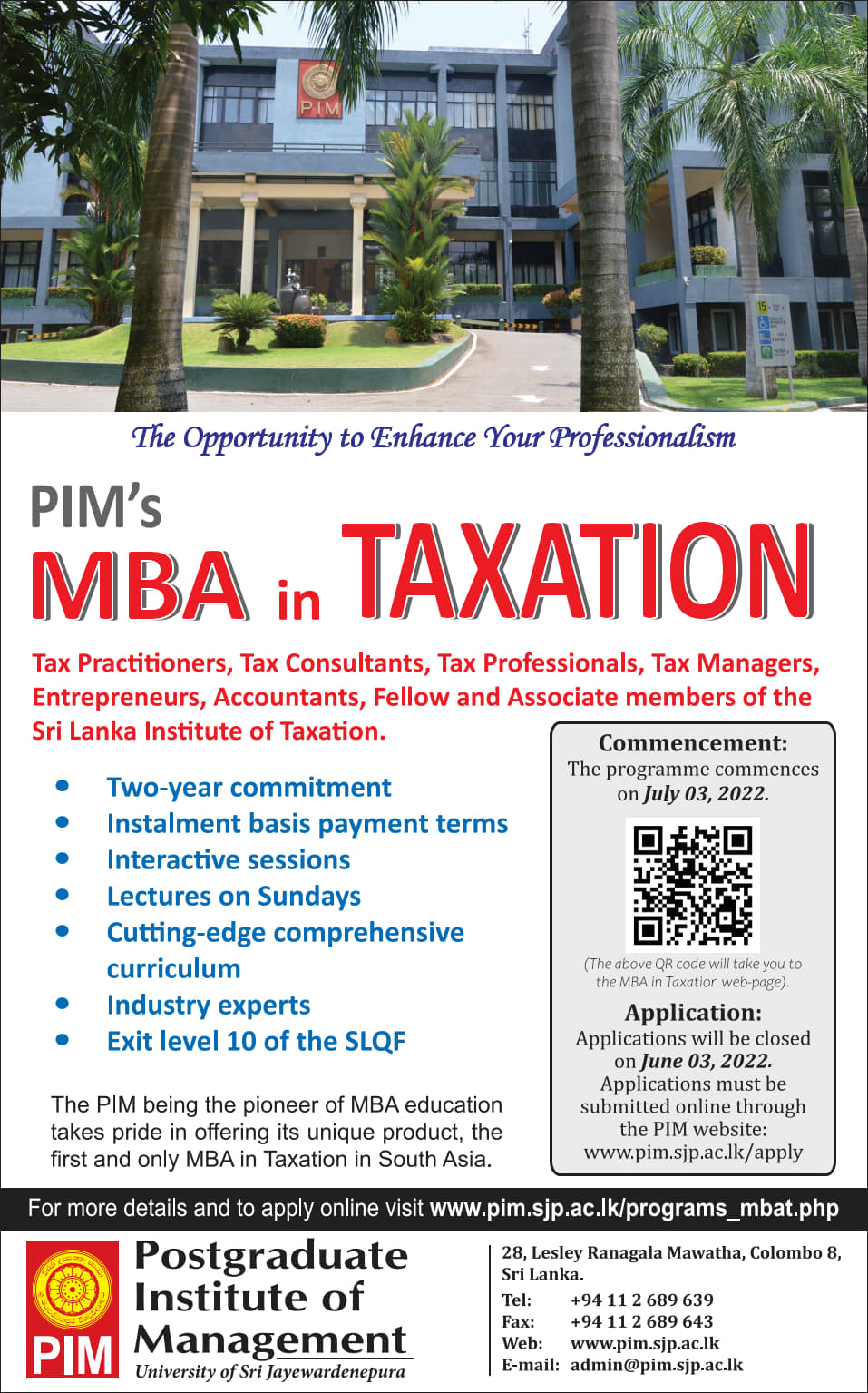

MBA in Taxation (PIM-USJP) – Applications are closing on 03rd June 2022

Apply Online: Link (Applications are closing on 03rd June 2022) Visit PIM MBA in Taxation programme page: Click here Who Can Apply Eligibility to apply for admission to the MBA-T Degree programme is determined according to the following criteria: One of the following qualifications: A Bachelor’s Degree, from a recognized university with at…

Special Goods and Services Tax Bill – 2022

This is to provide for the imposition of a special goods and services tax, in lieu of the sums chargeable on such specified goods and services by way of tax, duty, levy, cess or any other charge imposed by law; to promote self-compliance in the payment of taxes in order to ensure greater efficiency in…

Value Added Tax (Amendment) Bill – 2022

This amendment is to increase the VAT rate from 15% to 18% per centum on supply of financial services on financial institutions with effect from January 1, 2022 and to exempt certain goods and services from VAT in order to give effect to budget proposals of 2022. Download Bill – English | Sinhala

No penalties for submission of Income Tax Return for the Y/A 2020/2021

According to the provisions of the Inland Revenue Act, No. 24 of 2017 (IRA), every person who is liable for Income Tax shall file a Return of Income not later than eight months after the end of each Year of Assessment. Therefore, last date to furnish the Return of Income for the year of assessment…

Budget 2022 Analysis

Key Tax Proposals – Imposition of New Taxes Surcharge Tax It has been proposed to introduce a Surcharge Tax at the rate of 25% on individuals or companies, whose taxable income exceeds LKR 2,000 Mn for the year of assessment 2020/2021. This proposal has been introduced as one-time tax charge to the taxpayers. Social Security Contribution It…

Tax Payments & Returns due dates in the month of November 2021

Tax Payments & Returns due dates in the month of November 2021 Tax payments & Returns due Tax Payments & Returns due dates in the month of November 2021 dates and tax types & payment period codes for the month of November 2021 are as follows: NOVEMBER 15TH Advance Personal Income Tax (APIT) for the…

Now e-Service is available for filing CIT, IIT & PIT Returns Y/A 2020/2021

Electronic filing facility through e-service is available for filing the Return of Income for Companies, Partnerships and Individuals. A Company or a Partnership or an Individual should have a Personal Identification Number (PIN) and also a Company or a Partnership should have a Special Staff Identity Number (SSID) or SSID numbers for e-filing. Download IRD…

Tax Payments & Returns due dates in the month of October 2021

Tax Payments & Returns due dates in the month of October 2021 Tax payments & Returns due Tax Payments & Returns due dates in the month of October 2021 dates and tax types & payment period codes for the month of October 2021 are as follows: OCTOBER 15TH Advance Personal Income Tax (APIT) for the…

Tax Payments & Returns due dates in the month of September 2021

Tax Payments & Returns due dates in the month of September 2021 Tax payments & Returns due Tax Payments & Returns due dates in the month of September 2021 dates and tax types & payment period codes for the month of September 2021 are as follows: SEPTEMBER 15TH Advance Personal Income Tax (APIT) for the…

Receipt of Inward Remittances for Exports and Adjustment of Input Value Added Tax (VAT)

Department of Inland Revenue has published a paper notice on Receipt of Inward Remittances for Exports and Adjustment of Input Value Added Tax (VAT). Download Paper Notice No: PN/VAT/2021-06 | Dated: 05.08.2021

Tax Payments & Returns due dates in the month of August 2021

Tax payments & Returns due dates and tax types & payment period codes for the month of August 2021 are as follows: AUGUST 15TH Corporate Income Tax (CIT) 1st Instalment for the Y/A 2021/2022 is due on August 13, 2021 (Since August 14 & 15 fall on holidays), Online payment (OTPP) can be made until August…