The Finance Act No. 35 of 2018 imposes Carbon Tax in the following manner;

- Liable Persons: Registered owner of every motor vehicle

- Chargeable period: Every year (other than for the first year of registration of such motor vehicle)

- Effective Date: January 1, 2019

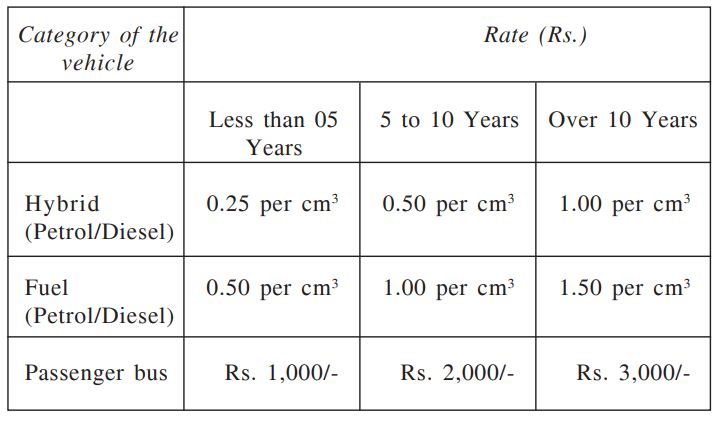

- Applicable Rates:

- Payment Due Date: On or before the due date of renewal of annual registration

- Collection Authority: Divisional Secretary (Every Divisional Secretary who collects any amount in shall

duly acknowledge the receipt of the tax so collected and remit such amount to the Commissioner General of Motor Traffic) - Exemptions: Shall not apply for any electric vehicle

Finance Ministry notice on Carbon Tax

The Finance (Carbon Tax) Regulations No. 01 of 2019 – [English | Sinhala]