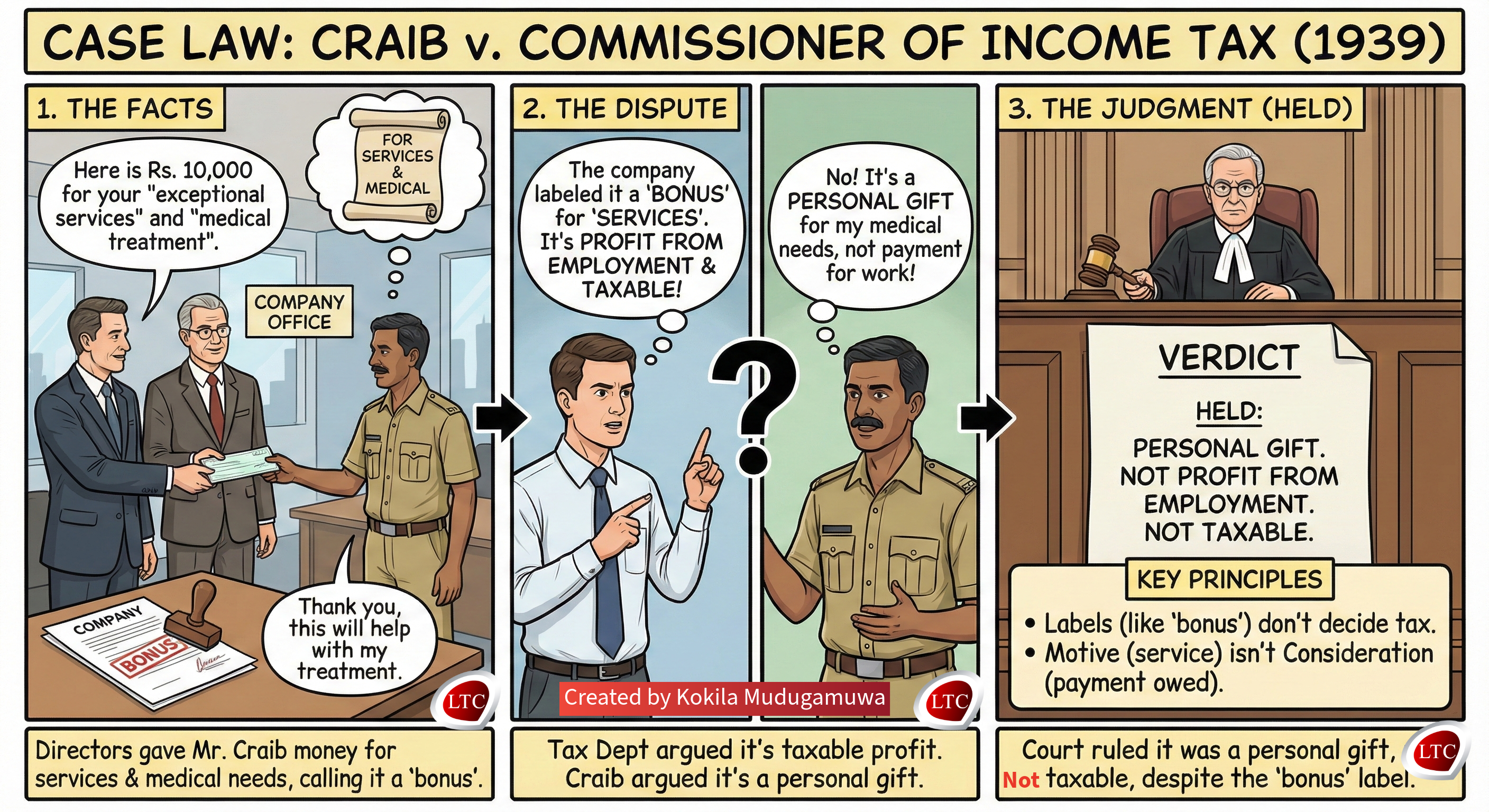

Case Name: Craib v. Commissioner of Income Tax (1939)

1. The Facts (What happened?)

- The Person: Mr. Craib was the Superintendent of Lellopitiya Estate.

- The Payment: The Directors of the company passed a resolution to give him Rs. 10,000.

- The Explanation: The resolution stated the money was granted for two specific reasons:

- In view of his “exceptional services to the Company”.

- In consideration of the fact that he had to undergo medical treatment while at home.

- The Confusion: The company called this payment a “special bonus” in their resolution and in their tax return.

2. The Dispute (The Argument)

- The Tax Commissioner’s View: Since the company called it a “bonus” and mentioned “services” in the resolution, the Tax Department argued it was “profits from employment” under Section 6(2)(a) of the Income Tax Ordinance and therefore taxable.

- The Taxpayer’s (Mr. Craib’s) View: He argued that despite the word “bonus,” the payment was actually a personal gift or testimonial used for his medical treatment and was not a reward for his job duties.

3. The Judgment (Held)

The Supreme Court ruled in favor of Mr. Craib. The payment was NOT taxable. It was considered a personal gift, not profit from employment.

4. Key Principles for Students (Why was it decided this way?)

- Don’t Get Stuck on Labels: The company called it a “bonus” to perhaps help their own accounting. However, the Court ruled that a taxpayer should not be penalized just because the employer chose a specific word (like “bonus”) either deliberately or accidentally. The reality of the payment matters more than the name given to it.

- Motive vs. Consideration: This is the most important legal distinction in the case. The Court noted that while Mr. Craib’s long service was the motive (the feeling that made the directors want to give the money), the service was not the consideration (the legal payment owed for the work).

- Personal Nature: The payment was distinguishable from a salary or commission because it was a personal gift given specifically because he needed medical treatment.

![VAT & SVAT Registration requirements for Tea, Rubber, and Coconut Suppliers – SEC/2024/E/01 [04 Jan 2023]](https://lankataxclub.lk/wp-content/uploads/2024/02/Can-Tea-Rubber-and-Coconut-Suppliers-get-SVAT-150x150.jpg)