UPDATE: Implementation of New Standardized Tax Invoice Format Postponed to April 2026

The Department of Inland Revenue has issued a critical update regarding Value Added Tax (VAT) administration. Per Gazette Extraordinary No. 2463/05, dated November 17, 2025, the Commissioner General of Inland Revenue (CGIR) has specified a mandatory format and specification for Tax Invoices. Subsequently, the Department of Inland Revenue has officially announced a postponement of the…

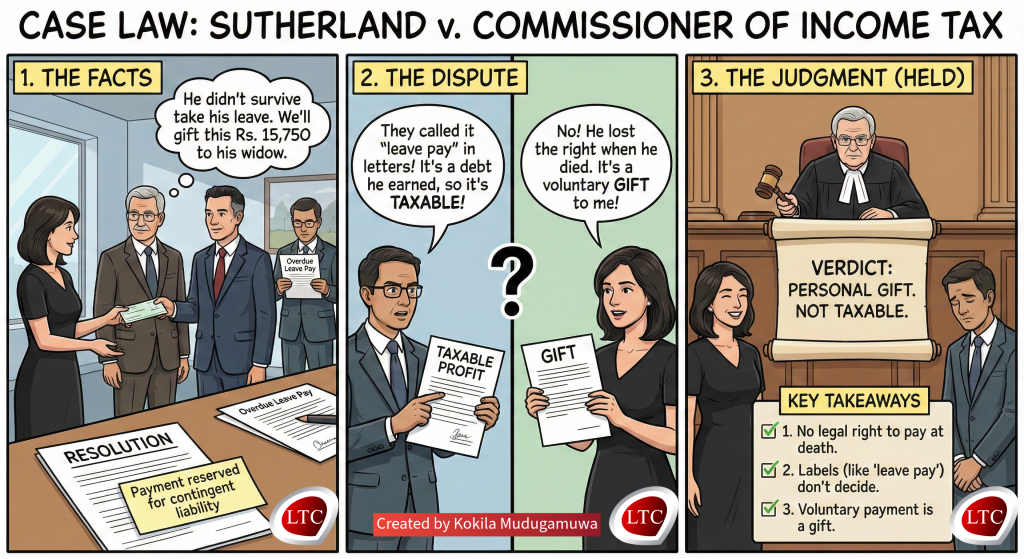

Sutherland v Commissioner of Income Tax (CTC Volume I)

Case Overview 1. The Facts (The Story) Mr. R.W. Sutherland was the Managing Director of the Colombo Apothecaries Company Limited. 2. The Dispute The core disagreement was about how to classify this Rs. 15,750. 3. The Judgment (Held) The Court ruled in favor of Mrs. Sutherland. The payment was NOT taxable. Reasons for the Decision:…

Bank & Finance Company TIN List for Interest Income & AIT/WHT Schedules

As tax season approaches in Sri Lanka, accurate data entry is critical for a smooth filing process. One of the most common administrative hurdles taxpayers and practitioners face is locating the correct Taxpayer Identification Number (TIN) for banks and finance companies. When preparing your Return of Income, you are often required to disclose specific details…

Budget 2026 – Key Revenue Proposals and What They Mean for You

The 2026 Budget introduces a series of revenue proposals aimed at broadening the tax base, creating a level playing field between local and imported products, and modernising Sri Lanka’s tax administration. This article summarises the main tax-related proposals and explains their practical impact on businesses and taxpayers. 1. VAT & SSCL on Imported Coconut Oil…

New VAT Rules for Digital Services Supplied by Non-Residents in Sri Lanka – Effective from 1 October 2025

Sri Lanka is taking a significant step in modernizing its tax system with the introduction of Value Added Tax (VAT) on digital services supplied by non-resident persons through electronic platforms to Sri Lankan consumers. This reform, effective from 01 October 2025, was formalized under the Gazette Notification No. 2443/30 dated 01 July 2025 and the…

Understanding Employment Income and APIT for Resident Individuals in Sri Lanka – Year of Assessment 2024/2025

In Sri Lanka, employment income taxation has undergone significant reforms in recent years, especially with the revival of Advance Personal Income Tax (APIT). For the Year of Assessment (YA) 2024/2025, salaried employees must be aware of how primary and secondary employment income is taxed and the importance of filing T-10 forms. This article serves as…

Simplified Value Added Tax (SVAT) Scheme in Sri Lanka

Simplified Value Added Tax (SVAT) Scheme in Sri Lanka By Kokila Mudugamuwa The Simplified Value Added Tax (SVAT) scheme was introduced by the Department of Inland Revenue in Sri Lanka on April 1, 2011, under the Value Added Tax Act. The primary objective of SVAT is to eliminate the need for VAT refunds for eligible…

Tax Invoice in Sri Lanka: A Comprehensive Guide

A tax invoice is an essential document in the administration of Value Added Tax (VAT) in Sri Lanka. It serves as evidence of a taxable transaction between a VAT-registered supplier and customer. Understanding the key elements of a tax invoice and the regulations surrounding its issuance is crucial for compliance with Sri Lankan tax laws….

Certificate of Income Tax Deductions (T-10): An Overview

The Certificate of Income Tax Deductions, commonly referred to as the T-10, is an essential document prescribed under Section 87 of the Inland Revenue Act in Sri Lanka. This certificate plays a vital role for both employers and employees in the process of Advance Personal Income Tax (APIT) compliance. Purpose of the T-10 Certificate The…

Understanding the 5% Advance Income Tax on Interest in Sri Lanka

In Sri Lanka, the taxation landscape has been evolving, and one of the significant changes that have garnered attention is the imposition of a 5% Advance Income Tax (AIT) on interest and discount on deposits. This article delves into the critical aspects of this tax, as outlined in the Inland Revenue Department’s Circulars SEC/2022/E/02 and…

What is Employment Income | How to calculate Assessable Income from Employment for the Y/A 2023/2024 & Y/A 2024/2025

Employment income is an essential component of taxation, representing the total gains and profits derived from an individual’s employment. This includes all remuneration received in cash or kind from an employer as compensation for services rendered. For the year of assessment (Y/A) 2023/2024 in Sri Lanka, employment income plays a pivotal role in calculating the…

Important Notice for VAT Registered Persons: Steps to Reclaim Credit Vouchers

The Inland Revenue Department (IRD) of Sri Lanka has issued a critical notice for VAT registered persons who have faced difficulties in obtaining Credit Vouchers for the clearance of deferred VAT at Customs. This issue has primarily arisen due to the issuance of Estimated Assessments on Value Added Tax (VAT) Returns. To address this, the…

Notice to Taxpayers: Beware of Fraudulent Activities

The Inland Revenue Department (IRD) of Sri Lanka has issued an important notice to all taxpayers regarding the recovery of outstanding taxes. This notice highlights a serious issue that has recently come to light and provides crucial guidance for all taxpayers to ensure their safety and proper compliance with tax regulations. Key Information The IRD…

![VAT & SVAT Registration requirements for Tea, Rubber, and Coconut Suppliers – SEC/2024/E/01 [04 Jan 2023]](https://lankataxclub.lk/wp-content/uploads/2024/02/Can-Tea-Rubber-and-Coconut-Suppliers-get-SVAT.jpg)

VAT & SVAT Registration requirements for Tea, Rubber, and Coconut Suppliers – SEC/2024/E/01 [04 Jan 2023]

The circular, identified as Circular No. SEC/2024/E/01 and dated January 4, 2023, addresses suppliers involved in the production of tea, rubber, and coconut products. The primary focus of the circular is on the registration process under the Value Added Tax (VAT) and the Simplified Value Added Tax Scheme. The circular outlines the specific industries that…

![VAT & SVAT Registration requirements for Tea, Rubber, and Coconut Suppliers – SEC/2024/E/01 [04 Jan 2023]](https://lankataxclub.lk/wp-content/uploads/2024/02/Can-Tea-Rubber-and-Coconut-Suppliers-get-SVAT-150x150.jpg)