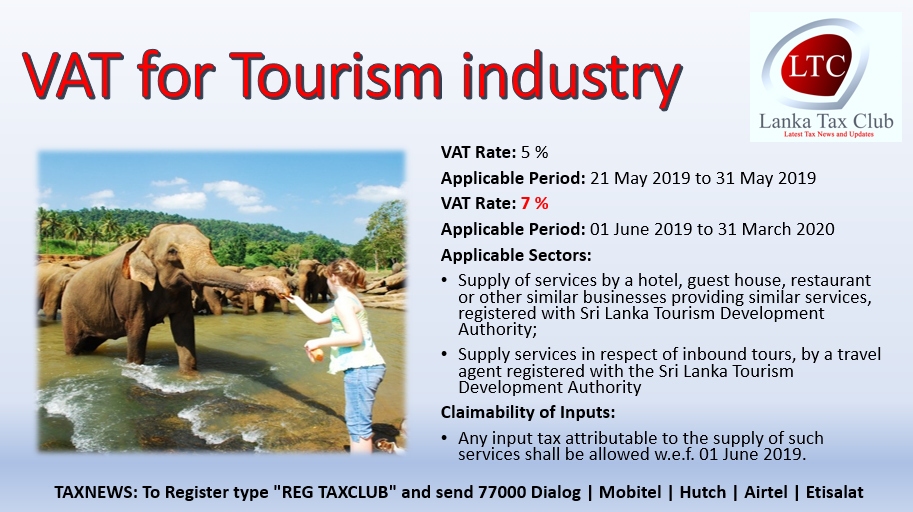

As per the Extraordinary Gazette Notification No. 2125/69 dated June 01, 2019, published under section 2A of the Value Added Tax Act, No. 14 of 2002 (VAT Act), VAT rate on the supply of services listed below is changed to 7% for the period commencing from June 01, 2019 and ending on March 31, 2020.

- Supply of services by a hotel, guest house, restaurant or other similar businesses providing similar services, registered with the Sri Lanka Tourism Development Authority;

- Supply services in respect of inbound tours, by a travel agent registered with the Sri Lanka Tourism Development Authority.

Accordingly, the order made under section 2A of VAT Act and published in the Extraordinary Gazette Notification No. 2124/3 dated May 21, 2019 is repealed with effect from June 01, 2019.

Therefore, VAT rate on supply of services listed above is as follows.

- For the period from 21.05.2019 – 31.05.2019 at 5% (No any input tax is allowed in terms of the third proviso to section 22(3) of the VAT Act).

- with effect from 01.06.2019 – 31.03.2020 at 7% (input tax allowable for the relevant taxable period is restricted to 100% of the output tax declared for that taxable period and any excess shall be carried forward to subsequent taxable periods in terms of paragraph (b) of section 22(10) of the VAT Act).

![VAT & SVAT Registration requirements for Tea, Rubber, and Coconut Suppliers – SEC/2024/E/01 [04 Jan 2023]](https://lankataxclub.lk/wp-content/uploads/2024/02/Can-Tea-Rubber-and-Coconut-Suppliers-get-SVAT-150x150.jpg)